Focus on STEM Draws Big Plans

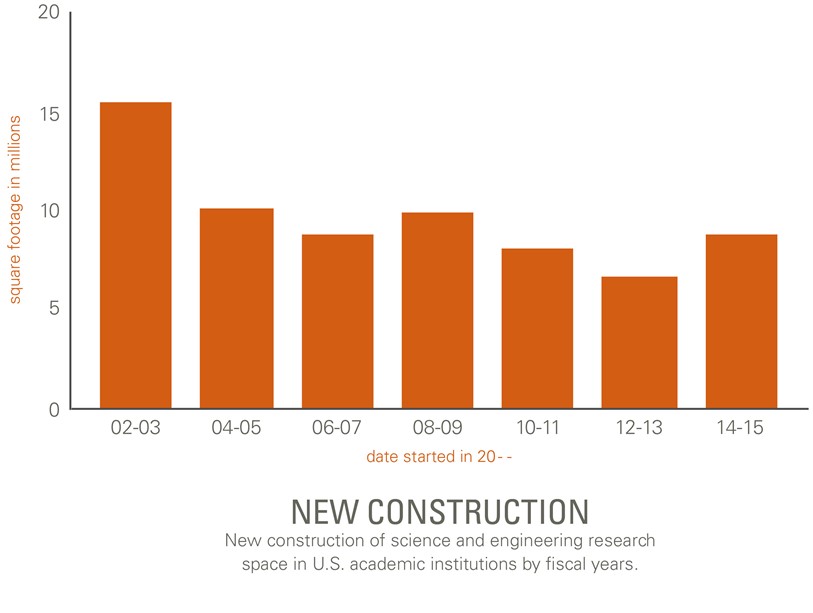

After the dives during and following the Great Recession, we are seeing universities and colleges stepping up their investment in STEM facilities again. It's not just our perception.

In the fiscal years of 2015 and 2014, 130 institutions planned to start construction on science and engineering research space, accounting for some 8.8 million square feet—the most added since the recession started, indicates the latest data from the National Science Foundation.

We’re pleased to see other data showing a similar trend.

Dodge Data & Analytics says construction starts, by value, for labs and research facilities, most of which are owned by higher education institutions, were up 27 percent in 2014 from the year before for a total of $3.7 billion in projects. Data for the first ten months of 2015 indicate that another $3.7 billion in projects were estimated to have been started last year.

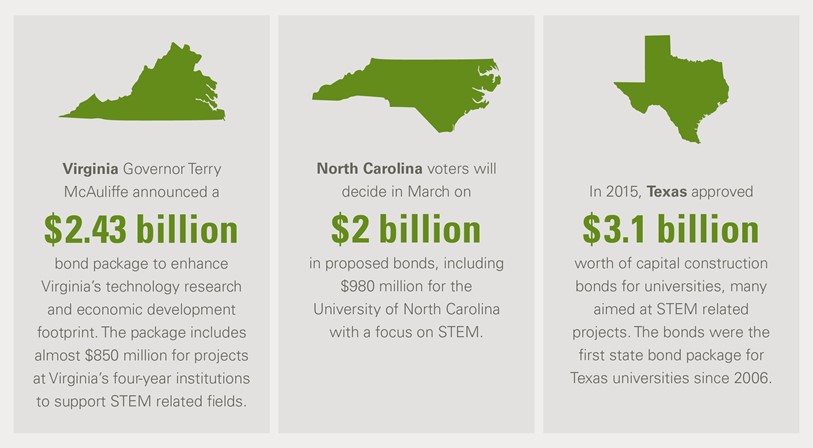

Recent announcements also indicate a strong emphasis on new and renovated STEM facilities on U.S. campuses.

Just last month, Virginia Governor Terry McAuliffe announced a $2.43 billion bond package to enhance Virginia’s technology research and economic development footprint. The package includes almost $850 million for projects at Virginia’s four-year institutions to support STEM related fields.

North Carolina voters will decide in March on $2 billion in proposed bonds, including $980 million for the University of North Carolina with a focus on STEM.

The growth in STEM facilities is hardly an East Coast phenomenon. Last year, Texas approved $3.1 billion worth of capital construction bonds for universities, many aimed at STEM related projects. The bonds were the first state bond package for Texas universities since 2006.

Big Trends Drive STEM

The need for new and renovated STEM facilities is being driven by a number of factors, all of which point to a better educated, innovative and employable workforce for decades to come. No less than President Obama has put a focus on growing STEM fields with his call for 10,000 new STEM graduates every year.

As we look to the year ahead, I thought it important to look at the major factors pushing STEM growth at universities, including:

Enrollment: STEM bachelor’s degrees increased 38% between 2004 and 2014 while non-STEM bachelor’s degrees rose 31%, indicates a study from the National Student Clearinghouse Research Center.

The Puget Sound Business Journal recently reported that the University of Washington now has so many biology students that it needs a new $160 million life sciences building. Construction is set to begin in June. Increasing demand for STEM grads inspired the new building, university officials said.

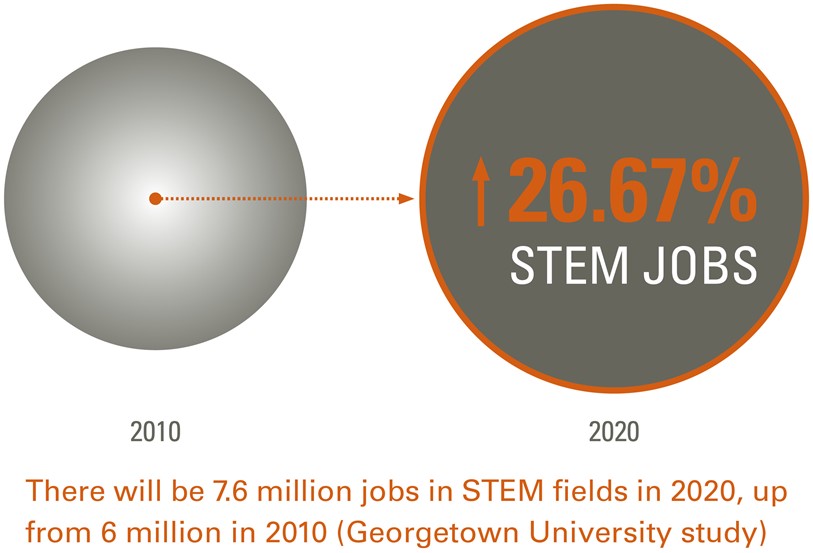

Job Potential: STEM students are chasing STEM jobs. Along with healthcare, community service and arts, STEM will be among the fastest-growing fields through the end of the decade, a Georgetown University study projects. It says there will be 7.6 million jobs in STEM fields in 2020, up from 6 million in 2010.

Competition: The University of Vermont has identified its 250,000-square-foot STEM complex, to be completed in 2019, as the highest priority in the school’s capital plan. In a 2014 letter to the university’s board urging support of the project, UVM Provost David Rosowsky underscored the competitive need for the new complex. Nationwide, Rosowsky wrote, top universities have made significant investments in STEM teaching and research facilities to attract the “best and brightest students and faculty.”

Aging Facilities: Nationwide, 15 percent (approx. 320M NASF) of the science and engineering research facilities in colleges and universities require renovation and another 4 percent (approx. 8.5M NASF) are in such bad shape they should be replaced, indicates the most recent data in the NSF survey of science and engineering research facilities.

Managing Growth Spurts

The addition of new STEM facilities, and the renovation of older ones, will no doubt increase our nation’s competitiveness. Still, as we’ve seen in the past, periods of robust construction can lead to unintended consequences.

We’ve already seen how the rebound in home and other construction following the Great Recession has led to increased costs for building materials and labor, lack of materials in some cases and construction delays. All of this can push construction costs beyond what institutions planned to spend.

As we sit on the cusp of what we think will be a robust period of construction for existing and, hopefully, new clients, we think it wise to strategize on how such risks can be avoided or mitigated.

To that end, we’d like to convene experts on all sides of this issue for a web-based discussion of how institutions can avoid becoming their own worst enemies in a busier construction landscape. These STEM facilities, after all, will empower institutions for decades to come and are critical investments. Please let us know if you would be interested and stay tuned for more information and your invitation to our upcoming webinar.

This post was written with contributions from Timothy F. Winstead, AIA, LEED AP